Protecting what matters most

We plan for holidays, home renovations, and retirement but we’re less likely to plan for the unexpected. Life insurance is one quiet but powerful way

We plan for holidays, home renovations, and retirement but we’re less likely to plan for the unexpected. Life insurance is one quiet but powerful way

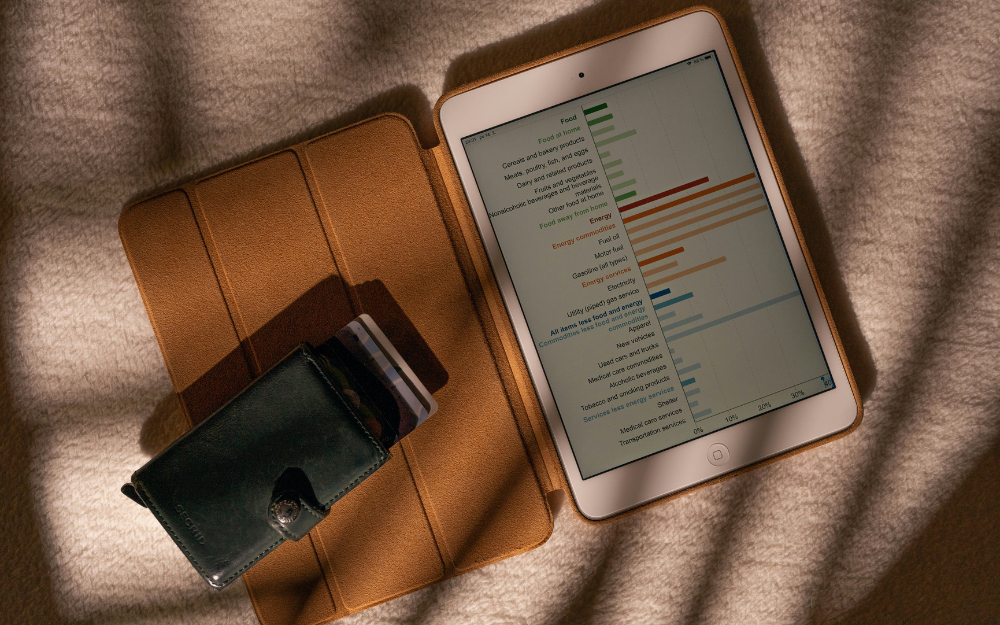

Everyone likes to know how they’re travelling compared to their peers and business owners are no different. To help you know how your business is

Why depreciation matters for investors of new property? Depreciation is what the Australian Taxation Office (ATO) recognises as the gradual decrease in value of your investment

Being your own boss comes with freedoms – and responsibilities. Find out how to make the right start. Manage your cash flow If you’re self-employed you’re in good company. More

Lots of stores offer consumer leases that allow you to rent an item like a laptop, TV or fridge. How a consumer lease works A

Self-managed superannuation fund (SMSF) trustees always have a lot on their to-do lists but the first few months of 2026 are likely to be busier

Getting paid on time is essential for managing cash flow and establishing a profitable business. And while staying on top of unpaid invoices helps, there

If your self-managed super fund (SMSF) had assets, such as super contributions or other investments as of 30 June 2025, you’ll need to lodge a SMSF

What you can claim You can claim a tax deduction for most expenses you incur in carrying on your business if they are directly related

There’s finally a small glimmer of good news for businesses that rely on Aussies spending on the ‘nice-to-haves’, with new data from CreditorWatch showing closures

Many investors breathed a sigh of relief at having survived (and even thrived) the turbulent economic and political events of 2025. Super funds posted strong

Running a business on your own requires stamina, discipline and a level of personal responsibility few people truly understand. However, the greatest strain often sits